2020-12-26 | Investing by the Numbers

Welcome to the very first Investing by the Numbers Newsletter for December 26th, 2020. If you celebrate Christmas then I hope you are enjoying a peaceful and relaxing holiday with family and loved ones. If you don’t celebrate Christmas then I hope you are enjoying your Friday as well as any holidays that you celebrate during this end of the year period.

The goal of this newsletter is to provide a unique quantitative analysis coupled with my subjective comments on each of the selected companies. Companies are selected for inclusion in this newsletter using a strict analysis criteria that does not consider the macroeconomic climate, breaking news, or other qualitative factors. This means that the numbers only tell part of the story. As a result, there will sometimes be companies which are included in the newsletter but come with commentary suggesting they may not be suitable for the current market.

Companies that find their way onto this newsletter will be tracked until the quantitative scoring system deems they should be removed. This typically happens in a time period of a few weeks to a few months.

One last important details, all the scoring charts are displayed with a logarithmic scale.

Value

Value companies overall saw price appreciation from early November through mid December, and the ones in this strategy are no exception. The strategy was fully allocated long and managed to out-gain SPYV. On Dec 15th the strategy increased it’s cash position as it sold out of a number of positions and kept those proceeds in cash. The current big picture market outlook is positive, with a score of 68.4%, but until new companies come up in the strategy the cash position will remain.

The list is currently strong in consumer cyclicals, with 3 home builders and a few more related businesses. Rounding out the list for this week are a couple mining companies and some technical service based companies.

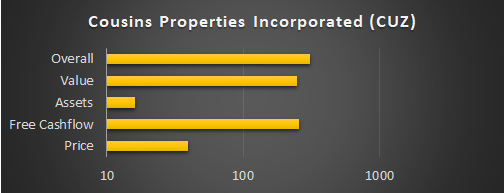

Cousins Properties Incorporated (CUZ)

This REIT invests primarily in high end office space located in the sun belt. CUZ presents an overall strong score of 311. The company is strong in cashflow and in the long term portion of the balance sheet.

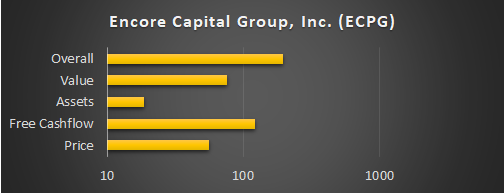

Encore Capital Group, Inc. (ECPG)

Encore Capital is a specialty finance company offering debt recovery solutions worldwide. In addition to working with debtors to repay their defaulted debts, they also work in early state collections. Similar to Cousins, Encore shows a strong cashflow position while offering a slightly lower value score of 76.

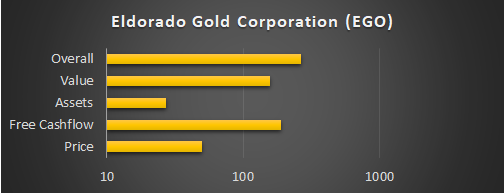

Eldorado Gold Corporation (EGO)

Eldorado Gold Corporation is headquartered in Vancouver, Canada and, as the name suggests, performs mining for gold, silver, lead, zinc, and iron. They operate in Turkey, Canada, Greece, Brazil, and Romania. In addition to offering a good value, gold miners should enjoy the likely inflationary medium term economic environment that is likely to come.

Excelon Corporation (EXC)

Exelon is a utility services holding company owning nuclear, fossil, wind, hydroelectric, biomass, and solar generating facilities. Exelon serves nearly every participant in the utility space with nearly every service these customers would need. With over 32,000 employees and a 40 billion dollar market cap, Exelon offers value and a modest dividend with a large cap size.

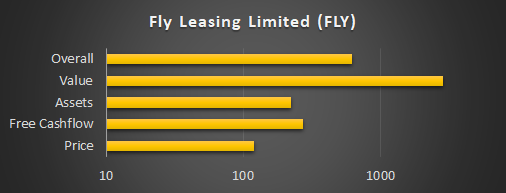

Fly Leasing Limited (FLY)

Fly leasing purchases and leases commercial aircraft to various airlines worldwide. As of December 31st 2019 their portfolio consisted of 89 aircraft.

Fly Leasing offered the highest overall score as of the market close on December 22nd at 615. That score is due in large part to the excessively large value score of 2858. In most cases such a large score should be a cause for concern rather than excitement because they are usually found in companies that have a fatal flaw. Fly Leasing is unique in this way because none of the four underlying scores are less than 100. Slightly tempering the strong numbers is the fact that Fly is a very small company with a 290 M market cap and an average of around 330000 shares traded daily.

After the strong market performance on December 23rd it’s a valid question of if that value is still present. Holders of Fly could consider a trailing stop to lock in gains while those not currently holding Fly may want to wait for a better price opportunity.

Gray Television, Inc. (GTN)

Gray Television is a TV broadcast company based in Atlanta, GA which owns and operates stations in the United States. Gray broadcasts secondary digital channels affiliated with ABC, CBS, and Fox in addition to an assortment of other channels. Gray is a larger small cap at 1.7 B and about 850000 shares traded daily. What really stands our for Gray is the impressive revenue growth over the past few years.

Gray has an overall score of 225.6 and one of the more healthy sets of supporting scores in the value strategy at the moment with no single category is below 40.

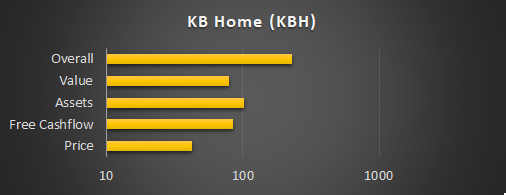

KB Home (KBH)

KB Home is a Los Angeles based home building company with over 2000 employees and a 3.4 B market cap. This mid cap consumer cyclical builds attached and detached single family homes, townhomes, and condominiums. KB Home operates mostly in the southern half of the United States with activity in Arizona, California, Colorado, Florida, Nevada, Washington, Texas, and North Carolina.

KB Homes is different from many companies on this list because it has a Assets as it’s highest rather than it’s lowest score with a value of 102.2.

KT Corporation (KT)

KT Corporation provides worldwide telecoms services from it’s home country of South Korea. This 5.7 B market cap company offers a wide range of services starting with phone, VOIP, internet services, and media content via streaming and satellite. Interestingly, KT Corporation is also involved in real estate development, software development, mobile marketing, satellite broadcasting, cloud system implementation, and the list goes on and on. In short, they are very active in seemingly every business related to phones, TVs, or computers.

Weak in assets, KT Corporation comes in strong in terms of cashflow with operating cashflow in excess of 3.6 B USD and a scoring of 159.4. But the asset score is a real detractor, beating only Exelon in this list of value companies. I believe the diversified income streams helps balance out the relatively weak assets score. But in a situation where I’m looking to size up positions, KT Corporation would be at the bottom of my list.

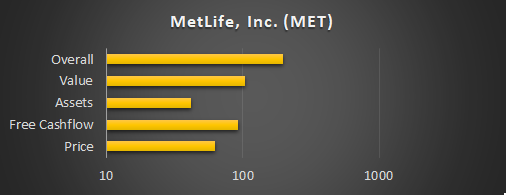

MetLife, Inc. (MET)

Large cap value is always nice, and few value companies are bigger than the 41.5 B dollar MetLife. This insurance company offers a full range of financial services across the globe.

MetLife is a great addition to the value list due to the well rounded set of scores it offers. Strong in value and decent in terms of asset scoring, it has an overall score of 195. To top things off, MetLife also comes with a 4% dividend at current pricing, or $1.84 per share.

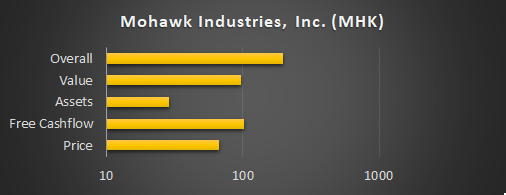

Mohawk Industries, Inc. (MHK)

At just under 10 B market cap, Mohawk Industries is large mid cap company offering flooring products for new construction and remodel residential and commercial spaces in the US, Europe, Russia, and other locations.

This Calhoun, GA based company has an overall score of 198 with the common weakness in the assets category. Compared to other companies on this list Mohawk isn’t impressive, but it’s ok.

M/I Homes, Inc. (MHO)

Continuing in the consumer cyclical sector is M/I Homes. M/I Homes is a Columbus, OH based company that builds single family homes in many of the states neighboring Ohio in addition to Texas, Florida, and North Carolina. Their homes are build to meet the needs of customers from the first time buyer to the luxury buyer.

M/I Homes has shown impressive and stable revenue growth climbing from 1.7 B in 2016 to 2.5 B in 2019. Coupling the strong revenue growth with high scores in Value and Assets you get a company that is my personal favorite on this list.

Meritage Homes Corporation (MTH)

Meritage Homes Corporation is yet another home builder on the value list, headquartered in Scottsdale, AZ with just over 1500 full time employees. They build single family homes in many of the same locations discussed with previous home builders, Texas, Arizona, California, Colorado, Florida, North and South Carolina, Georgia, and Tennessee.

Meritage and M/I Homes both have similar scores, with Meritage leading in assets and only 1 point behind M/I Homes at 227.6 for an overall score. The largest difference I can find is in the specific markets these two companies do business. Meritage is in the usual southern markets while M/I Homes is active in Ohio and it’s neighboring states.

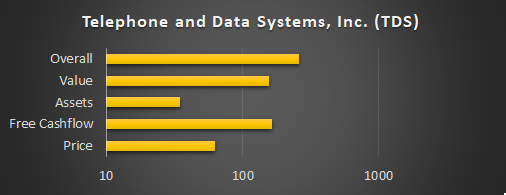

Telephone and Data Systems, Inc. (TDS)

Telephone and Data Systems is a Chicago based telecom company employing over 9000 people. They provide cellular service, sell wireless devices and accessories, and offer wireline internet, television services, and telephone services.

This nearly 2 B market cap company is well rounded in scoring, with an overall score of 260.9. Revenues and earnings are fairly flat over the past few years. If you’re look for a reason why this company makes the list then you’ll find it on the balance sheet. TDS has a current ratio of 2.77 and more than $9 in cash per $18 share.

Teck Resources Limited (TECK)

Teck Resources Limited is a Vancouver, CA based mining company. They operate via their steelmaking coal, copper, zinc, and energy segments. Teck also produces gold, silver, and some other industrial products.

A look at the balance sheet shows non current assets at 34.9 B CAD vs 14.5 B CAD non current liabilities. The difficulty is that 31.4 B of those non current assets are associated with property, plant and equipment assets. What is the value of a mine owned by a bankrupt company? I’m going to assume it’s something close to 10% of what the balance sheet reflects. But with an overall score of 260.5 this company has a place in the value list.

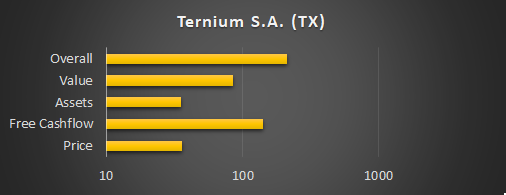

Ternium S.A. (TX)

Ternium is a steel company headquartered in Luxembourg with facilities in the United States and a number of Central and South American countries. Ternium produces a number of steel products such as slabs, billets, bars, and hot rolled flat products in their Steel segment. Their mining segment offers iron ore and pellets. This mid cap company has a share price of just over $30 and an average volume of 386000 shares traded per day. Ternium is one of the more well balanced companies on the value list due to their high assets score of 35.49.

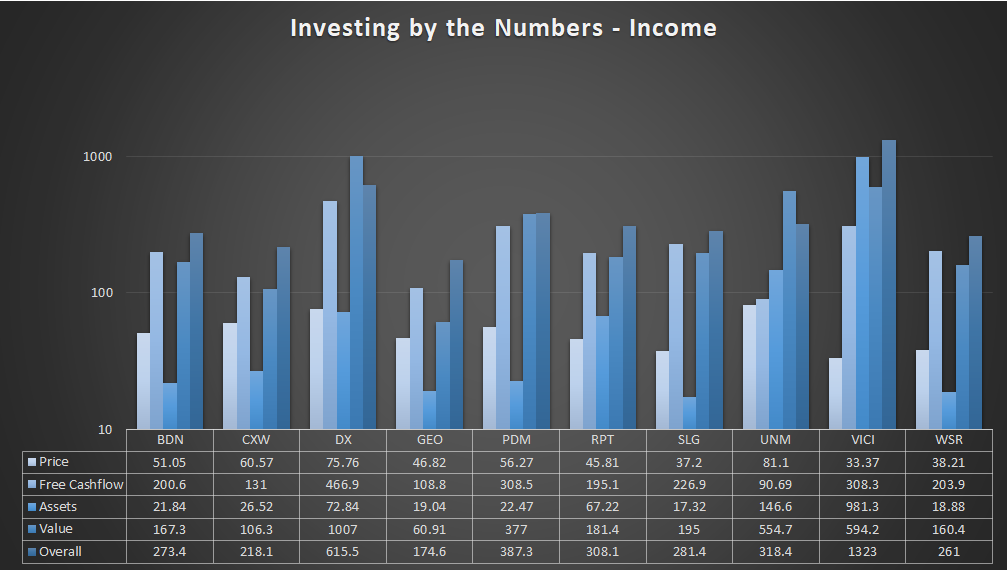

Income

Income companies enjoyed overall strong performance in November and were flat for all of December. This flat trend in recent weeks can be seen in the shorter than usual list of companies in the Income list. Cash is strong component of this strategy for the moment.

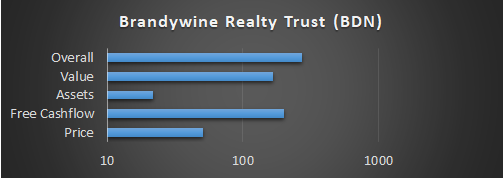

Brandywine Realty Trust (BDN)

Brandywine Realty Trust is a REIT which focuses on the markets of Philadelphia, Austin, and Washington DC. This REIT has a market cap of 2 B and a dividend of $0.76 on a share price of $11.76, or about 6.5%.

CoreCivic, Inc. (CXW)

CoreCivic is a unique REIT who serves the needs of the government with corrections, detention management, and a network of residential reentry facilities. They also claim to be the nation’s largest owner of these types of facilities, and have a long relationship of working with the government.

On June 17th, 2020, CoreCivic announced they would be suspending their quarterly dividend while it reassesses how to best use their cash flow. The share price dropped 17% after that announcement, and has continued to decline. Today CXW is trading at just under $7, down from around $12 prior to the announcement.

So why would a company that doesn’t pay out dividends be in the Income list? Well, it’s currently still a REIT which means they are required to pay out at least 90% of their taxable income in the form of dividends. It’s entirely possible that CoreCivic will not remain a REIT going forward. If the dividend is reinstated at the previous rate then that would be $1.76 per year paid on a $7 share price.

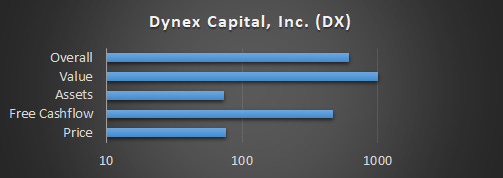

Dynex Capital (DX)

Dynex Capital is a real estate investment trust (REIT) based in Glen Allen, VA which pays a monthly dividend of $0.13 per $17.72 share. This 8.8% dividend combined with an overall score of 615.5 places Dynex Capital near the top of the list. Sounds great right? What could possibly go wrong? Dynex Capital invests in mortgage backed securities on a leveraged basis. The aggressive nature of business combined with the small cap size of 410 M means that this company isn’t suitable for a larger than normal position size.

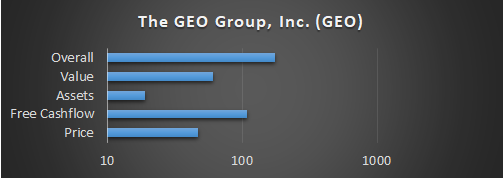

The GEO Group, Inc. (GEO)

The GEO Group is a real estate investment trust based in Boca Raton, FL which specializes in the design, financing, development, and operation of secure facilities, processing centers, and community reentry centers in the United States, the United Kingdom, Australia, and South Africa. In total they own or manage 123 facilities with 93000 beds.

CoreCivic is a similar but slightly smaller company, coming in at about 840 M market cap vs 1.1 B for the GEO Group. Unlike CoreCivic, GEO is presently paying a dividend at a yield of over 15%.

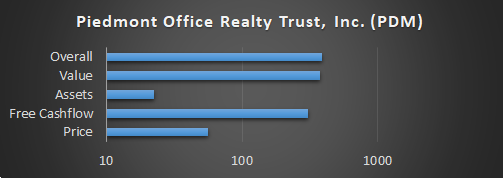

Piedmont Office Realty Trust, Inc. (PDM)

Piedmont Office Realty Trust is an owner, manager, developer, redeveloper, and operator of Class A office properties located in seven east coast markets. Their portfolio includes about 17 million square feet, valued at $5 B. This 2 B market cap REIT pays a yield of 5.2% via a quarterly $0.21 dividend.

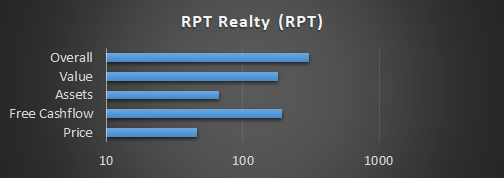

RPT Realty (RPT)

RPT Realty is a New York, NY based real estate investment trust that owns a national portfolio of open air shopping properties. The portfolio of RPT Realty includes 11.9 million square feet of leasable area divided between 49 distinct shopping centers. Before being suspended, the quarterly dividend payment was $0.22 per share for a yield of just over 10%.

SL Green Realty Corp. (SLG)

SL Green Realty is a real estate investment trust that focuses on commercial properties locaetd in Manhattan. SL Green Realty holds an interest in 93 buildings providing 40.6 million square feet. The revenue history is far from ideal, but this is balanced by they stable earnings that hover at around 250 M dollars per year.

Prior to 2020, SL Green paid a quarterly dividend. Starting in March 2020, the dividend was changed to a monthly payment of $0.295 per share. On December 4th SL Green declared a dividend of $2. These values represent a yield of 8.2% for 2020.

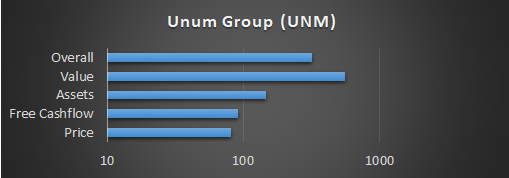

Unum Group (UNM)

Unum Group is an insurance company based in Chattanooga, TN that provides full range of group and individual insurance policies. In addition to their 5.2% dividend yield, they also have a value score that’s greater than 500. With only 4.5 B in market cap, they don’t make the cut to be considered large cap, but Unum Group does help to balance the smaller REITs found earlier in this list.

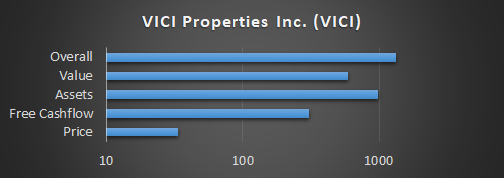

VICI Properties Inc. (VICI)

Keeping the real estate investment trust trend going is VICI Properties. This REIT is unlike any of the previously discussed companies because VICI has a market cap of nearly 14 B making it a large cap company. VICI specializes in gaming and hospitality, with the world-renowned Caesars Palace as the biggest name in it’s 29 gaming facility portfolio. That portfolio also consists of 19200 hotel rooms and over 200 bars, restaurants, and nightclubs.

VICI has over 500 M in earnings in both 2018 and 2019. Based on the quarterly reports of 2020 earnings, VICI will have in excess of 700 M and possibly as much as 1 B in earnings on the year. I would call a company like VICI a bargain at a PE ratio of 18, and the value score of 594 confirms my assessment. Oh, and the dividend yield is 5.1%. VICI is my favorite company on the Income list for their numbers but also for the nature of their business.

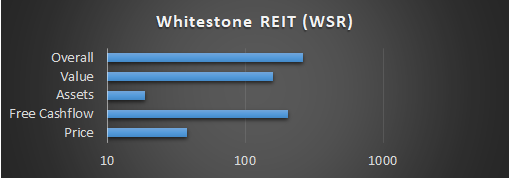

Whitestone REIT (WSR)

Whitestone is a community centered shopping center REIT that holds a portfolio of high quality open air neighborhood centers primarily in the largest and fastest growing markets in the sunbelt. Whitestone is on the smaller side of things with a market cap of only 335 M and an average of only 346000 shares traded daily.

In March 2020 a reduction of $0.06 in the monthly dividend left the payment at a meager $0.035. The previous dividend level had been in place without interruption since August 2013. Despite this decline, the dividend yield is still a healthy 5.3%.

The Investing by the Numbers newsletter is a periodic newsletter providing quantitative and qualitative analysis of selected companies for general informational purposes. This newsletter offers analysis which may not be suitable for any given individual reader or subscriber. Each person reading or listening to this material must retain sole discretion and responsibility for their financial and investment decisions. Anyone making investment or financial decisions should do so only after seeking the advice of an investment or financial professional. This newsletter does not constitute financial or investment advice. Lowercase Capital LLC shall not be held liable for any investment decisions made as a result of this newsletter.

The system driving the quantitative portion of the newsletter is the same analysis process that is used in the Equity Income Directional and Equity Value Directional strategies offered by Lowercase Capital LLC. The information used in this newsletter is obtained by sources believed to be reliable but is not guaranteed to be entirely accurate or complete. Lowercase Capital LLC makes no representations or warranties regarding the accuracy or completeness of the information contained in this newsletter.

The companies discussed in this newsletter will often be held by strategies offered by Lowercase Capital LLC to it’s clients. Lowercase Capital LLC is not compensated by any company discussed in this newsletter for inclusion in the product.

Lowercase Capital LLC is the copyright owner of all text and images contained in this newsletter, except as otherwise noted. Other parties’ trademarks and service marks that may be referred to herein are the property of their respective owners. Newsletter subscribers may print or save digital copies of this newsletter for their exclusive personal use only. Any redistribution of this newsletter other than the permitted used previously stated is strictly prohibited.